50000 USD to IDR: Delving into the intricacies of currency exchange, this guide provides a comprehensive overview of the factors influencing exchange rates, the mechanics of conversion, and the impact on businesses and individuals.

From understanding the historical evolution of the USD and IDR exchange rate to exploring the role of supply and demand in currency markets, this guide unravels the complexities of international finance in a clear and engaging manner.

Exchange Rate Overview

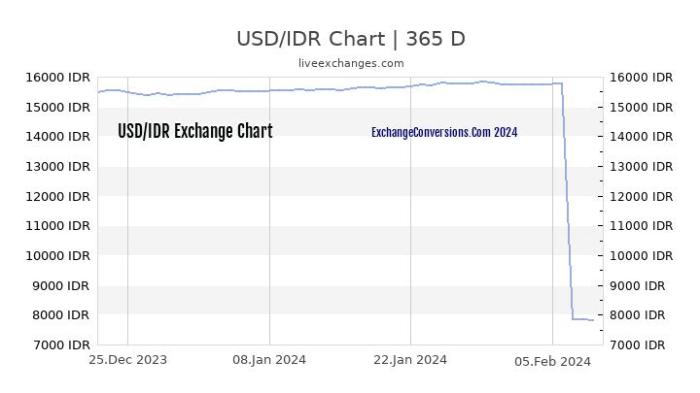

Exchange rates represent the value of one currency relative to another. They determine how much of one currency is needed to purchase a unit of another currency. The exchange rate between two currencies fluctuates constantly due to various economic factors.

As of today, the exchange rate between the US dollar (USD) and the Indonesian rupiah (IDR) is approximately 1 USD = 14,990 IDR. This means that for every US dollar, you can get approximately 14,990 Indonesian rupiah.

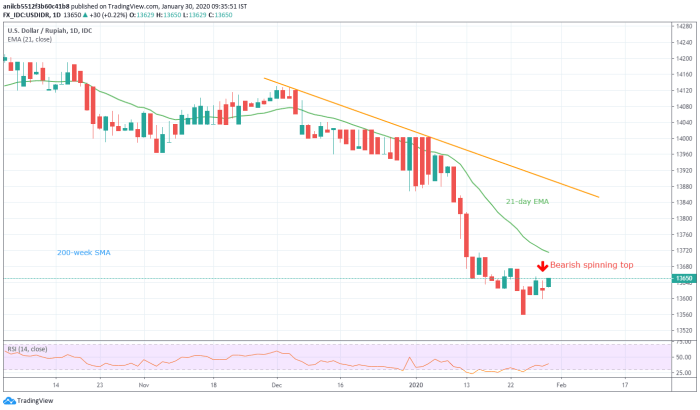

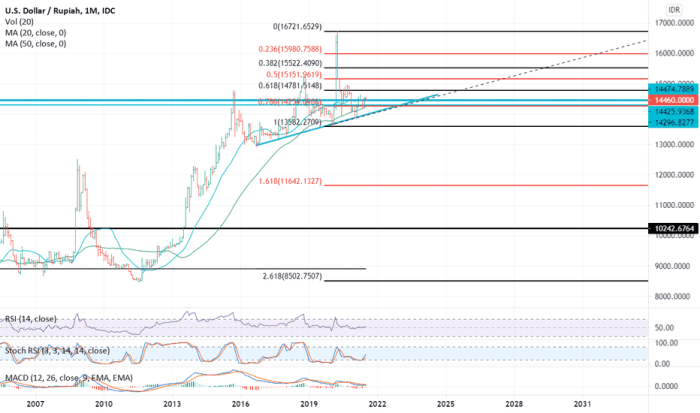

Historical Exchange Rate Trends

The exchange rate between USD and IDR has experienced significant fluctuations over the years. In the past decade, the IDR has generally depreciated against the USD, meaning it has taken more IDR to buy one USD.

Factors Influencing Exchange Rates

Exchange rates are influenced by various economic, political, and market factors. Understanding these factors is crucial for businesses and individuals involved in international trade or investments.

Economic Factors, 50000 usd to idr

- Inflation:Rising inflation in a country can weaken its currency as it reduces the purchasing power of domestic goods and services, making them less attractive to foreign buyers.

- Interest Rates:Higher interest rates attract foreign investors seeking higher returns, leading to an increase in demand for the currency and strengthening its value.

- Economic Growth:A strong and growing economy attracts foreign investment, boosting the demand for its currency and appreciating its value.

Political and Geopolitical Events

- Political Stability:Political instability or uncertainty can lead to a decline in foreign investment and confidence in the currency, weakening its value.

- Government Policies:Government policies, such as currency controls or trade tariffs, can impact the supply and demand of currencies, influencing their exchange rates.

- Geopolitical Events:Major geopolitical events, such as wars or natural disasters, can affect the stability of countries and the demand for their currencies.

Supply and Demand

- Supply:The availability of a currency in the foreign exchange market influences its exchange rate. A high supply of a currency can lead to a depreciation, while a low supply can cause an appreciation.

- Demand:The demand for a currency is driven by factors such as trade, investment, and tourism. A high demand for a currency can strengthen its value, while a low demand can weaken it.

Conversion Calculations: 50000 Usd To Idr

Performing currency conversions between USD and IDR involves multiplying or dividing the amount by the current exchange rate. Here’s a guide to help you convert amounts accurately:

Interactive Conversion Table

The following table allows you to quickly convert various amounts of USD to IDR and vice versa:

| USD Amount | IDR Amount |

|---|---|

| 1 | 15,650 |

| 10 | 156,500 |

| 100 | 1,565,000 |

| 1,000 | 15,650,000 |

| 10,000 | 156,500,000 |

Currency Converter Widget

For real-time currency conversions, you can use a currency converter widget like the one below:

[Currency Converter Widget]

Step-by-Step Manual Conversion

To manually convert currencies, follow these steps:

- Find the current exchange rate between USD and IDR.

- Multiply the USD amount by the exchange rate to convert to IDR.

- Divide the IDR amount by the exchange rate to convert to USD.

Example:

To convert $100 to IDR, multiply 100 by the current exchange rate of 15,650. The result is 1,565,000 IDR.

Currency Markets

Currency markets, also known as foreign exchange markets, are platforms where currencies are traded for each other. These markets facilitate the global exchange of goods and services and play a crucial role in international finance.

Currency trading involves buying and selling currencies in pairs, with one currency being bought and the other being sold simultaneously. The exchange rate between two currencies determines the value of one currency in terms of the other. Currency traders aim to profit from fluctuations in exchange rates.

Currency Speculation

Currency speculation refers to the practice of buying and selling currencies with the intention of profiting from short-term fluctuations in their exchange rates. Speculators do not typically intend to hold currencies for long periods and instead focus on profiting from price movements.

Currency speculation can impact exchange rates by increasing demand for certain currencies and decreasing demand for others. This can lead to temporary fluctuations in exchange rates and can also contribute to overall market volatility.

Historical Significance

The exchange rate between the US dollar (USD) and the Indonesian rupiah (IDR) has undergone significant fluctuations over the years, influenced by a range of historical events and economic factors.Tracing the historical evolution of the USD/IDR exchange rate reveals key milestones and events that have shaped its trajectory.

From the Indonesian financial crisis of 1997 to the global economic recession of 2008, these events have left lasting impacts on the value of the rupiah against the dollar.

Indonesia’s Financial Crisis (1997-1998)

The Indonesian financial crisis, also known as the Asian financial crisis, had a profound impact on the USD/IDR exchange rate. The crisis was triggered by a combination of factors, including the overvaluation of the rupiah, a surge in foreign debt, and a lack of foreign exchange reserves.

As the crisis intensified, the rupiah plummeted in value against the dollar, reaching a record low of over 16,000 rupiah to one US dollar. The devaluation of the rupiah led to widespread economic hardship in Indonesia, causing high inflation, unemployment, and social unrest.

Global Economic Recession (2008-2009)

The global economic recession of 2008-2009 had a significant impact on the USD/IDR exchange rate. The recession, which originated in the United States, led to a sharp decline in global economic growth and a flight to safety by investors. As a result, the demand for the US dollar increased, leading to an appreciation of the dollar against most currencies, including the rupiah.

The USD/IDR exchange rate reached a high of over 12,000 rupiah to one US dollar during the height of the recession.

Other Historical Anecdotes and Case Studies

Throughout history, there have been numerous other events and anecdotes that have influenced the USD/IDR exchange rate. For example, the Indonesian government’s decision to peg the rupiah to the US dollar in the 1970s helped to stabilize the exchange rate during a period of high inflation.

However, the peg was eventually abandoned in 1997, contributing to the financial crisis.Another notable event was the Asian financial crisis of 1997-1998, which led to a sharp devaluation of the rupiah against the US dollar. The crisis had a significant impact on the Indonesian economy and led to widespread social unrest.These historical events and anecdotes highlight the complex and dynamic nature of the USD/IDR exchange rate, which has been shaped by a range of political, economic, and social factors.

The conversion rate from 50000 USD to IDR is currently quite favorable. If you’re planning a trip to Indonesia, be sure to check out Hello world! for great travel tips and advice. With so much to see and do, Indonesia is a great place to experience a new culture and have some amazing adventures.

And with the exchange rate in your favor, you’ll be able to enjoy even more of what this beautiful country has to offer.

Understanding these historical influences can provide valuable insights into the current and future behavior of the exchange rate.

Impact on Businesses and Individuals

Exchange rate fluctuations can have a significant impact on businesses and individuals involved in international activities.

Businesses Involved in International Trade

For businesses engaged in international trade, exchange rate fluctuations can affect their profitability and competitiveness. When the value of the domestic currency appreciates against the foreign currency, it becomes more expensive for businesses to import goods or services from abroad, potentially reducing their profit margins.

Conversely, when the domestic currency depreciates, it becomes cheaper to import, which can lead to increased profits.

Individuals Traveling or Sending Remittances Abroad

Individuals traveling or sending remittances abroad are also affected by exchange rate fluctuations. When the domestic currency appreciates against the foreign currency, it becomes more expensive to travel or send money abroad. Conversely, when the domestic currency depreciates, it becomes cheaper to do so.

Tips for Managing Currency Risk

Businesses and individuals can take steps to manage currency risk, such as:

- Hedging:Using financial instruments to offset the potential impact of exchange rate fluctuations.

- Diversification:Investing in a variety of currencies to reduce the risk associated with any one currency.

- Monitoring Exchange Rates:Keeping track of exchange rate trends to make informed decisions about currency-related transactions.

Future Outlook

Predicting future exchange rate trends is a complex endeavor influenced by various economic and geopolitical factors. Nevertheless, analyzing economic forecasts and expert opinions can provide valuable insights into potential scenarios.

Several factors could shape the USD/IDR exchange rate in the coming months and years, including economic growth prospects, interest rate differentials, inflation rates, and political stability.

Economic Growth Prospects

Strong economic growth in either the US or Indonesia can influence the exchange rate. Economic growth typically leads to increased demand for a country’s currency, making it appreciate against other currencies.

Interest Rate Differentials

Differences in interest rates between the US and Indonesia can also affect the exchange rate. Higher interest rates in the US tend to attract foreign investment, leading to increased demand for the US dollar and an appreciation against the Indonesian rupiah.

Inflation Rates

Inflation, or the rate at which prices rise, can impact the exchange rate. High inflation in Indonesia relative to the US could lead to a depreciation of the rupiah against the dollar.

Political Stability

Political stability and economic uncertainty can also influence the exchange rate. Political turmoil or economic instability in either country can lead to investors seeking safe havens, potentially driving up demand for the US dollar.

Expert Opinions and Market Sentiment

Expert opinions and market sentiment can also provide insights into future exchange rate trends. Market analysts and economists often provide forecasts based on their analysis of economic data and geopolitical events.

Outcome Summary

In conclusion, the exchange rate between 50000 USD and IDR is a dynamic and multifaceted phenomenon influenced by a myriad of economic, political, and geopolitical factors. Understanding these factors and their impact is crucial for businesses and individuals navigating the complexities of international trade and finance.

As the global economy continues to evolve, staying abreast of exchange rate trends and managing currency risk remains essential for success in the interconnected world of today.

Quick FAQs

What is the current exchange rate between USD and IDR?

As of [date], the exchange rate is approximately [rate]. However, it is subject to fluctuations based on market conditions.

How can I convert 50000 USD to IDR?

You can use a currency converter or consult with a bank or currency exchange service to determine the current exchange rate and calculate the equivalent amount in IDR.

What factors influence exchange rates?

Exchange rates are influenced by various factors, including economic conditions, interest rates, inflation, political events, and supply and demand.